Pop Quiz: I do cash flow projections:

Pop Quiz: I do cash flow projections:

a. to get funding from an investor

b. when my bank asks for them

c. at least once a year

d. umm… is this a trick question?

If you answered a, b, or d we need to talk. Now.

For the one person who answered c (there’s a teacher’s pet in every class), we still need to talk.

Let’s transform this villainous task to a super tool.

The Real Villain

Creating a cash flow projection is a task that might beat out filing tax returns by a narrow margin. The difference is that you are required to file taxes every year.

Generally, small businesses create cash flow projections to meet some requirement, such as obtaining a bank loan or attracting and acquiring investors. After that, they become dust collectors or get the circular file treatment.

I often hear this common start-up mantra, “I need sales before I need to worry about cash flow.”

You are wrong. Wrong, wrong, wrong.

If you wait until you need cash, it will probably be too late. Companies can (and do) grow themselves right into the ditch. Yes, rapid growth can cause your small business or solo practice to fail.

Don’t believe me? Here’s a quick example.

A small website services company just received a huge contract to build an intricate website from scratch for a Fortune 100 company. While it is the chance of a lifetime, they will need to sub-contract a large portion of the work. The client wants invoicing to be net 60 and triggered by benchmarks in the project.

The problem? In order to get paid, you need to start delivering on the project. To deliver on the project, you need to hire contract employees. The contract employees need to be paid every week starting now. Where do you get the money?

Since obtaining a loan, line of credit or investor takes time, time this small company doesn’t have, one of three things happens:

• They use credit cards, with high interest rates wiping out their profits and then some.

• They try to do it without outside help and deliver late or sub-par work.

• They pass on the work, losing out on an amazing opportunity for their company.

Convinced you need one, but wondering who has time to create and maintain complicated cash flow projections on a regular basis? Fear not!

I’m going to show you how to get a quick and dirty cash flow done in 30 minutes or less!

The Basic Ingredients

While a large deal or investment should and will require a detailed cash flow projection, you don’t need that for operating your business on a monthly basis. In fact, you can get a bare bones cash flow using only four ingredients:

1. Expected Monthly Income – This is actual cash or cash equivalents in hand. If it wouldn’t increase your bank balance, do not count it here.

2. Regular Monthly Expenses – This is a number most small business owners know off the top of their head and includes the usual suspects; rent, staff, telecommunications, etc.

3. Anticipated Expenses (not monthly) – There are some expenses that only occur once or twice a year. Examples include insurance, attorney fees or CPA fees at tax time.

4. New Business Strain – These are expenses above your regularly planned operating expenses when you bring in new business. In the web company example, their new business strain would be the additional contract employees. A rough estimate is fine.

Go with the (Cash) Flow in 30 Minutes

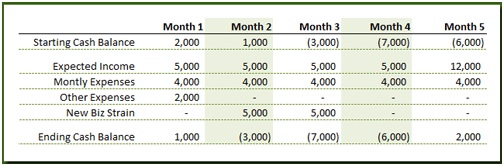

Open up a blank spreadsheet and label columns for at least the next 12 months. You will also need to label 6 rows for Starting Cash Balance, our 4 ingredients and Ending Cash Balance.

To calculate the Ending Cash Balance, simply add the Starting Cash Balance plus Expected Income minus Monthly Expenses, minus Other Expenses, minus New Biz Strain.

Using the numbers in the graph for Month 1:

$2,000 + $5,000 – $4,000 – $2,000 = $1,000

The previous month’s ending cash balance is the beginning cash balance for the current month.

That’s it. You are done!

Final Thoughts

Creating and using this simple cash flow projection lets you see the cash flow impact of winning large new clients or growing widget sales by 300%. Armed with this knowledge, you can prepare liquidity options before you need them and focus on delivering an excellent experience for your new customer.

What has your past history been with cash flow projections? Will you use them now? Or will they continue to be relegated to tchotchke status?

* * *