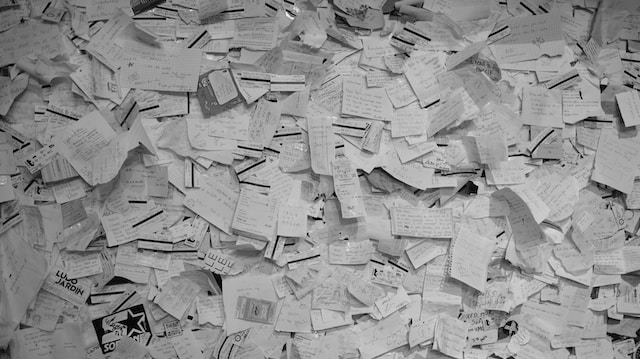

Your small business has started growing, the sales are now coming, and you have sales invoices and expense receipts scattered all around you. You likely haven’t taken the time to process and file them properly.

Now is the time to become serious about the accounting aspect of your business. Otherwise, you risk making decisions that will leave your business in a financial mess.

But don’t worry because this article provides you with six accounting tips that will help you as a business owner.

1. Draw a line between personal and business expenses

Don’t make the mistake of using your personal bank account as your business bank account – or vice versa. Doing this might lead you to using business funds for a personal financial problem, which can put your business at risk.

Instead, draw a line by opening a business account where all revenue generated by your business will be deposited. This simplifies filing business taxes and protects your business’s funds.

2. Create a budget

Every small business needs to create a budget. This should contain the expenses and revenue your business projects within a specific period of time, usually one year.

The budget will guide you as a business owner on how to achieve or surpass your set revenue and minimize your expenses.

Let’s assume you took a business loan to fund a project in your business. You can note how you plan to spend it in your budget so you can generate revenue to repay the loan, interest, and also make a profit.

3. Understand tax

As a business owner, you will have to stay up-to-date with tax laws, especially sales tax laws in the location you operate your business.

Let’s assume your business is located in the United States. The sales tax law in Texas varies from that of Nebraska. This matters most if you sell online because you must accurately collect it from customers who make purchases in your store and remit to the state.

4. Use invoicing software

Using technology can increase efficiency and decrease costs. Consider using invoicing software to automatically create and send invoices. This streamlines your billing process and saves the time and resources you would have spent hiring someone else to handle it.

5. Save receipts

A receipt is evidence of a payment your business made. You need it to track expenses and document spending in the financial statements for your business.

You can save your receipts via different methods. Printing and physically filing the paper is common but outdated. This method is also risky because you can lose files to fire or theft.

Saving your receipts electronically is a better method. Google Drive and Dropbox are cloud storage platforms where you can create folders and upload, save, and access your business receipts at any time.

6. Ask for help

Don’t hesitate to seek help when you encounter challenges while trying to understand your business finances. Nobody knows it all, and it’s better to ask questions than to make costly mistakes.

Read articles from small business financial experts or accounting firms regarding the issue you want to resolve. Watch YouTube videos to learn how to use features of your accounting software, and consult an accountant if you need to.

Being in control of your small business’s finances is key to achieving your business goals.

While some situations may require consulting with an accountant, you can do a lot on your own and limit that expense.

The tips I shared above will help you remain in control of your cash flow, be tax compliant, and make informed financial decisions in your business.

Photo by Christina Radevich on Unsplash